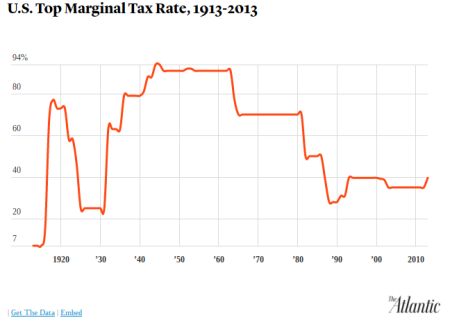

An unexpected dynamic within the debate about income and wealth inequality is the effect of income taxes on the management and how that affects the way the corporations are run. When income taxes were much higher for the wealthy, there was less incentive to grow a corporation which meant there was less incentive to squash competition. As income tax rates decreased, there has been a stronger incentive to either acquire competitors or drive them out of business. One consequence has been another strong incentive to drive down internal costs, particularly employee compensation. This second or third order effect helps explain a new dynamic behind the rich getting richer while the poor are getting poorer.

“What’s more, between 1993 and 2012, the top 1 percent saw their incomes grow 86.1 percent, while the bottom 99 percent saw just 6.6 percent growth, according to Saez’s research.” – The Atlantic

“When Gains At The Top Hurt Those At The Bottom” – The Atlantic

Pingback: Data That Matters July 2016 | Pretending Not To Panic