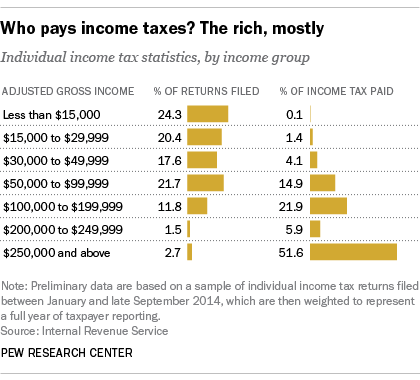

Figuring out income taxes makes many people think about wealth and income inequality. Many debates begin based on who is paying how much and whether it is fair. In general, US taxes are lower than taxes in other countries. Whether lower taxes are good or not, the poor have difficulty paying their taxes despite a progressive tax rate. The richest 0.1% are frequently accused of paying no or very little tax; which can be a consequence of income from capital gains or by hiding money in off-shore accounts. It turns out that the largest source of revenue for the US government (51.6%) is the upper middle class that are making more than $250,000/year. People making $118,500 or less carry an additional burden that isn’t progressive: payroll taxes. The issue may be more than rich versus poor and may be more people versus corporations. Corporations now only account for about 10.6% of US tax revenue, but they paid two or three times that in the 1950s. Corporations have possibly relied on tax havens more than people have relied on tax havens. Tax havens are so secretive that we don’t know. The paradox of US taxes is not the apparent contradiction of rich versus poor, but may have more to do with people versus corporations. It is just easier to talk about rich versus poor because that struggle has been going on longer, and corporations are better at paying for image control.

(Click on the chart for the link.)

“High-Income Americans Pay Most Income Taxes, But Enough To Be Fair?” – Pew Research