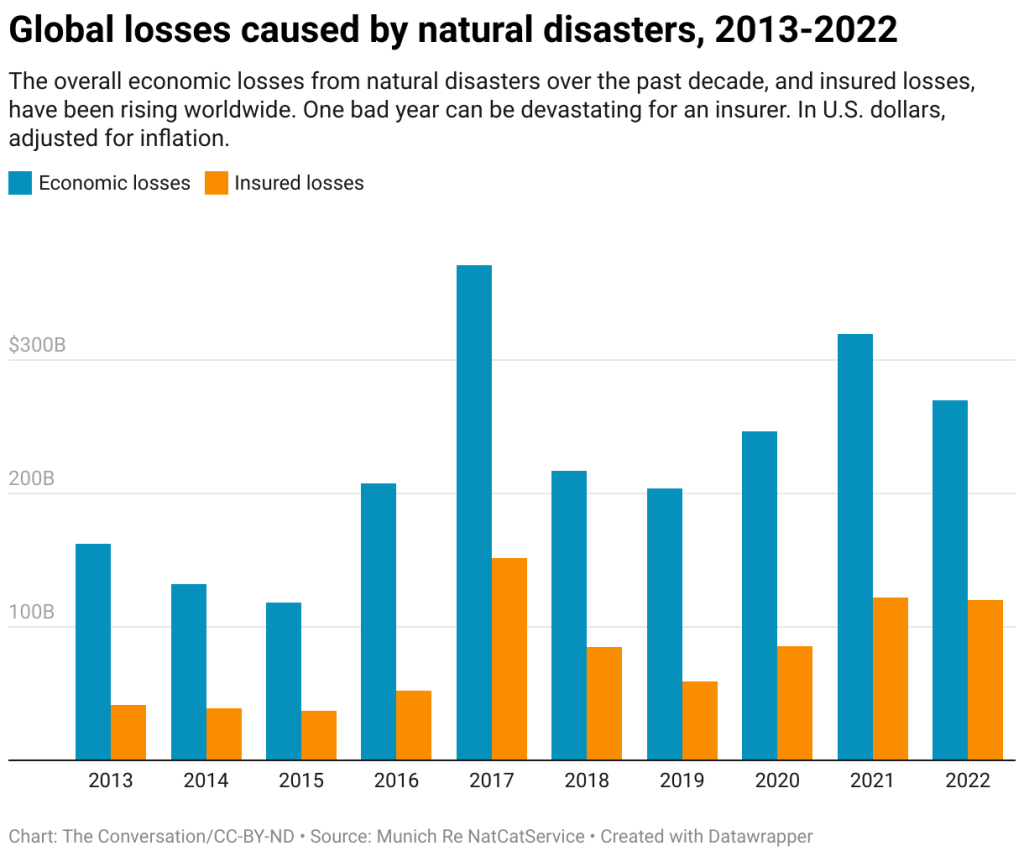

Insurance companies are deciding to not insure people because the costs are too high. State Farm and All State will no longer offer home insurance in California, as well as in other states like Florida. Climate change may be academic for some; but, for insurance companies natural disasters are real. In 2013, the insurers paid out $41.6B. In 2022 that rose to $120B. Multi-billion dollar payouts can bankrupt a company. Of course, they may be a multi-billion dollar company thanks to insurance premiums, but at some point the costs increase more the company thinks it can survive.

“Reinsurers’ risk-adjusted property-catastrophe prices rose 33% on average at their June 1, 2023, renewal, after a 25% rise in 2022, according to reinsurance broker Howden Tiger’s analysis.” – Conversation

As climate change becomes noticeable and accelerates, many people may find their homes un-insurable. As expensive as the payouts have been, the total cost is much higher because not every cost is insured against. The cost from natural disaster to the insurers was $120B in 2022, but the total cost was more than twice that, $270B. Early warnings about climate change estimated costs to eventually rise into the trillions. We may be on that un-insurable trajectory.

Pingback: Data That Matters June 2023 | Pretending Not To Panic

Pingback: Popular Posts 2023 | Pretending Not To Panic